Payroll processing is essential for any business, but managing it can be time-consuming and complex. That’s why several businesses want to outsource their payroll services to a reliable provider. However, with so many options available, knowing what to look for can be difficult. Payroll management involves more than just issuing the paychecks, it includes tax withholdings, benefits deductions, and recordkeeping. Understanding payroll basics helps small business owners maintain efficiency and avoid costly mistakes.

An HRMS payroll management system’s main function is to calculate the salaries, withhold the right amount of deductions and taxes, print paychecks, and deliver them. If you optimize an HRMS solution for your business, you can greatly reduce the time and manual workload necessary to carry out numerous tasks. Some HRMS solutions also have web-based SAAS features, which can be handy for managing an organization’s HR duties effectively.

Running payroll involves multiple tasks, including calculating wages, deducting payroll taxes, and updating financial records. A payroll management system automates many steps to streamline the payroll process and ensure that the employees receive timely compensation and that your company meets its tax obligations.

In the pre-payroll processing phase, an automated system can very well streamline the collection of essential employee data like time worked, salary changes, or adjustments to the deductions and the withholdings. During the processing, the payroll management system evaluates the overall compensation and applies the deductions or adjustments, saving valuable time and decreasing the risk of errors.

Most payroll management systems also handle post-payroll, automatically completing and filing necessary payroll tax forms and issuing paystubs.

Transforming the payroll processes with a Human Resource Management System (HRMS) offers a holistic solution to these problems. HRMS systems automate and integrate the diverse HR functions, including payroll, which can considerably impact the accuracy, efficiency, as well as compliance. By leveraging the technology, companies can streamline the payroll operations, reduce chances of manual errors, and improve the productivity.

HR as well as payroll services streamline the management of your complete workforce, ensuring efficiency at any cost and compliance. HR services cover the complete employee lifecycle, including crucial aspects that recruitment, employee onboarding, training and employee performance management, while also handling the employee relations as well as regulatory compliance. Payroll services ensure accurate as well as timely payment of wages, managing the deductions, benefits, and tax withholdings. By integrating all these functions, businesses can decrease the administrative hurdles, minimize the errors, and focus only on the strategic growth. These services improve their operational efficiency, boost employee satisfaction, and ensure complete adherence to legal requirements, permitting organizations to maintain a well-supported as well as a motivated team.

Also Read: How Smart HR Solutions is Redefining Employee Engagement

An HRMS payroll solution offers very clear advantages. Here are some of the main ones:

The HRMS solution you choose greatly depends on your organization’s needs. However, certain factors will influence your decision.

One of HRMS’s most significant advantages is the automation of payroll tasks. By automating wages, overtime, deductions, and tax calculations, HRMS reduces the risk of manual errors and speeds up the entire payroll process. Automation also ensures that the payroll is processed on time, reducing the delays and improving employee satisfaction.

HRMS systems integrate payroll with the other HR functions like benefits administration and time tracking. This integration provides a very holistic view of the employee data and streamlines various processes. For instance, automated time tracking can be directly linked to the payroll calculations, ensuring that employees are paid accurately depending on their recorded hours.

Many organizations find it challenging to ensure complete compliance with the ever-changing regulations. HRMS systems help to manage this complication by incorporating the up-to-date tax tables, labor laws, and compliance guidelines. This functionality reduces the risk of compliance issues and ensures that the payroll is processed according to the current regulations.

A small business with a growing and emerging workforce struggled with manual payroll processing and compliance issues. By implementing an HRMS, they fully automated payroll calculations and integrated time tracking, significantly minimizing the payroll processing time as well as improving the accuracy. Due to timely and accurate paychecks, employee satisfaction increased.

A large enterprise faced challenges with managing the payroll for a diverse global workforce. They implemented an HRMS with the multi-currency and multi-country otentialiyies, facilitating seamless payroll processing across diverse regions. The HRMS also provided an advanced reporting and analytics, helping the company make data-driven decisions.

Paying your employees on time and correctly is critical in maintaining morale, engagement, and productivity. Payroll management software helps you keep this important commitment while also delivering benefits like:

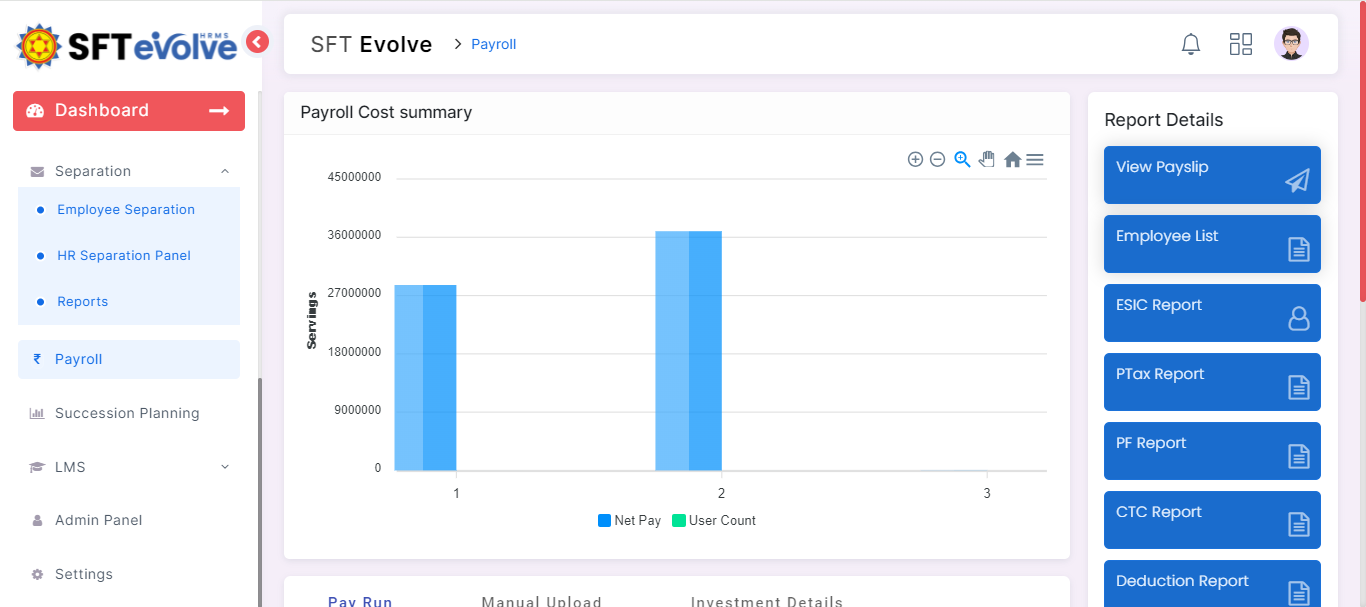

SFT Evolve HRMS‘ payroll software offers a compelling selection of features for employers seeking an end-to-end payroll management solution capable of automating even complex tasks for a global organization.

Designed for a high degree of flexibility, SFT Evolve HRMS also allows you to customize your payroll workflows, approvals, and reporting at a granular level. Visit https://sftevolve.com/ now!